P2p bad credit loans

P2p loans for bad credit. Peer-to-peer loans for bad credit are much more accessible in todays online world than in years past.

Ultimate List Of Crowdfunding Loans For Bad Credit Borrowers Crowd101

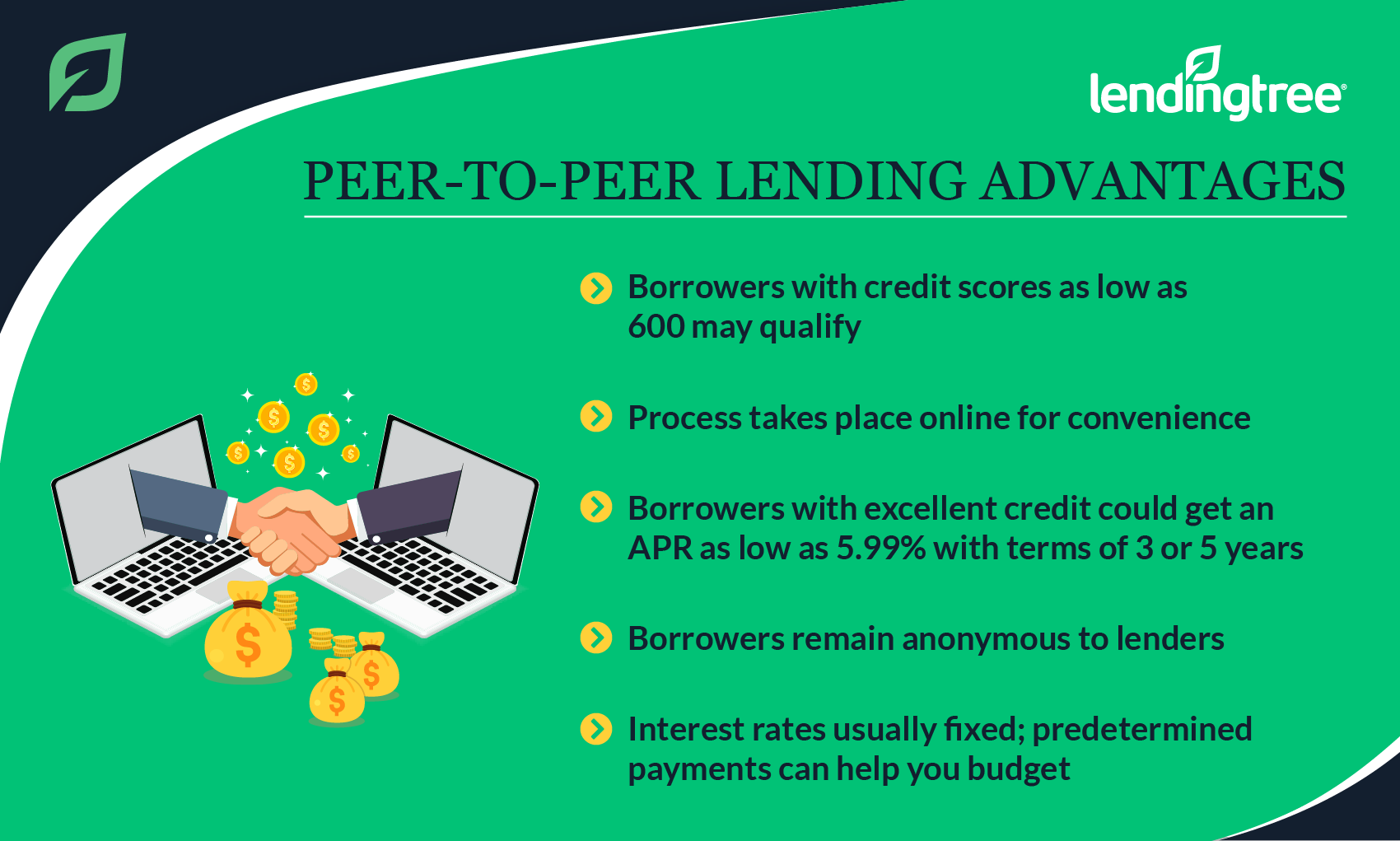

Peer loans have fixed payments and a fixed payoff date giving you a.

. Same Day Loan Best Guaranteed Loans for Emergencies. 275000 - 3000000. Thats why the most popular use of peer loans has been for credit card consolidation and to get out of the cycle of payday loans.

5 hours agoWeLoans - Best Same Day Loans with Simple Requirements. 4 hours agoCheck out the list to find the best deal. There are peer to peer lending bad credit sites that offer hefty peer-to-peer loans for bad credit in some cases up to 35000 USD even to small business owners or online sellers with very bad credit scores in some cases as low as 580.

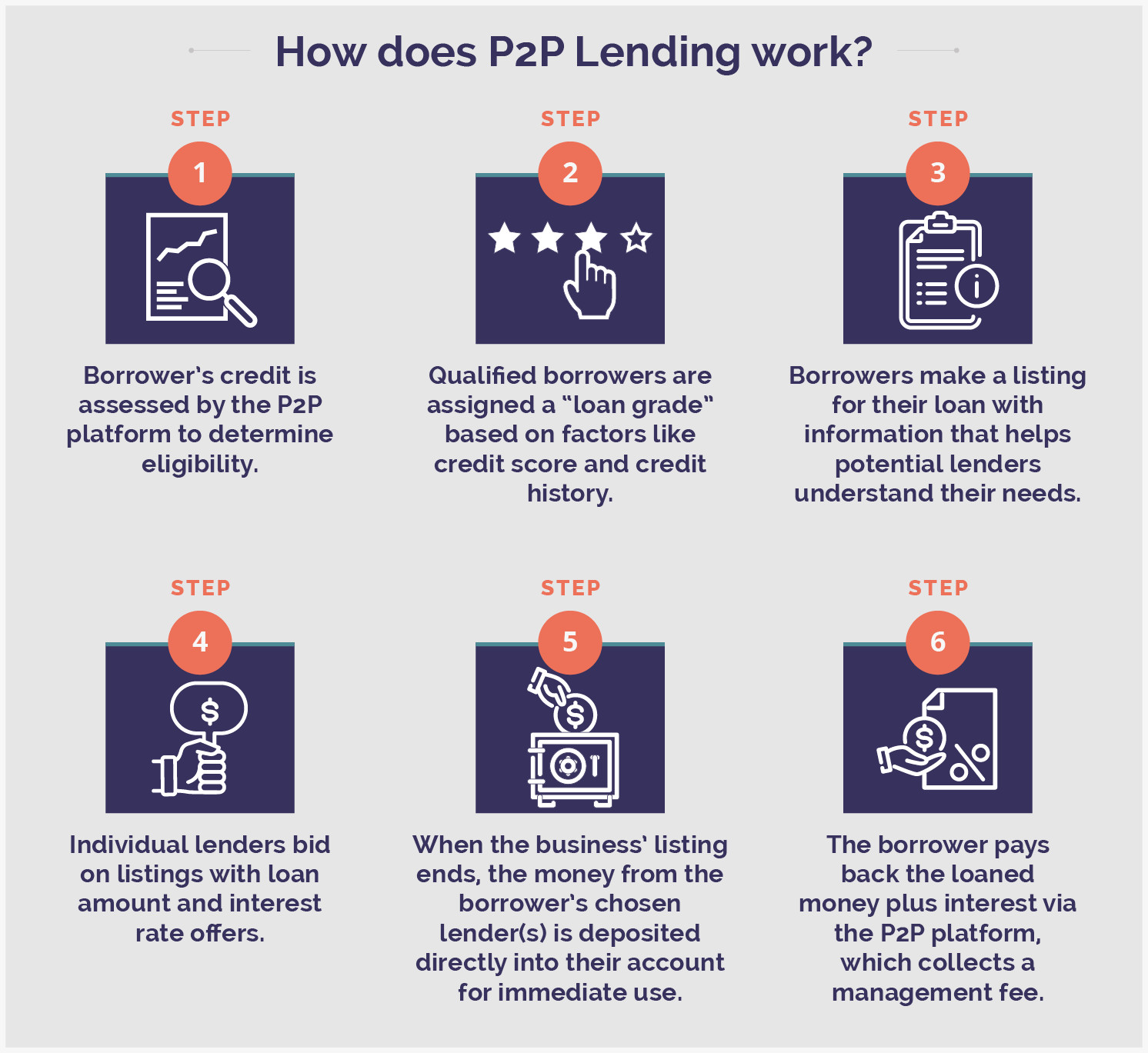

In other words there could be multiple lenders who decide to. By the end of 2013 the five largest peer-to-peer lending institutions Funding Circle Lending Club Prosper RateSetter and Zopa had nearly 35 billion in outstanding loans according to Fitch Ratings a mere drop in a bucket compared to their estimated and not unlikely 114 billion potential. Fast application There is still checking of credit history involved to gauge a borrowers capability to repay but they arent as strict as compared to banks or other traditional companies.

Applicants can ask for a loan amount between 1500 and 20000. The P2P lending industry has been growing steadily at an annual rate of 325 between 2014 and 2019. Same Day Loan is.

CocoLoan - Best for Keeping Your Information Safe. High interest rates may be offered on bad credit loans. It really is easier getting authorized despite having fico scores below 600.

Although getting a loan with a bad credit score is difficult this company makes the process easy and fast. By contrast family loans may have no contracts or simple contracts where the. We fund Bank turn downs fast.

These P2P lending companies provide 1 and 5 year loans to the borrowers at a fixed interest rates. Its an alternative to getting a loan from a financial institution such as a bank. P2P lending has been around for a long time and practiced among individuals even before banks had been established.

Traditional banks often deny loan applications from borrowers with credit scores less than 680. Moreover loans send directly to creditors receive APR discounts of 025 to 1. Best Bad Credit Loans for Applicants with Bad Credit Scores.

IPaydayLoans - Best for Not Charging Fees While Applying. The minimum credit score requirement is 550 and there are no application prepayment or late payment fees. No Collateral Signature Based Loan Options in San Fernando.

Best Personal Loans for Bad Credit of September 2022. Often P2P Loans for Bad Credit are authorized thanks to grades in school online reputation with social networking systems and work history too. Best Lending Platform for.

Under a specific policy for lending programs for those with bad credit there are no. Peer-to-peer lending is a method of financing without going through a bank. One of the most famous P2P lending platforms in the US today Lending Club offers the following benefits to borrowers.

GET A RATE QUOTE NOW. 598 up to 3589 depending on FICO score. Even though you have bad credit you may still be eligible to consolidate your debt into an unsecured personal loan.

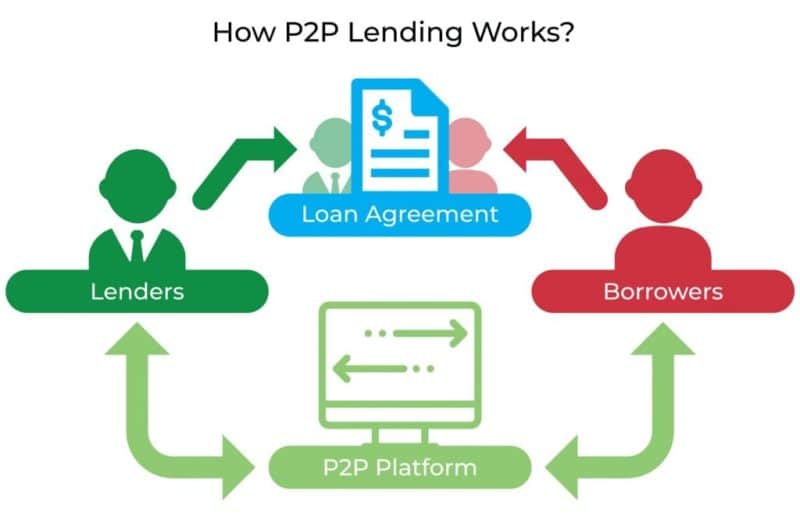

Simply put it eliminates the middleman through the procedure. The models of balance sheet lending and P2P lending described above. One of the benefits of this approach is that individual lenders are not required to fund the entire loan.

P2P Bad Credit Loan Rates. Peer-to-peer P2P lending also known as social lending is defined as an act of lending or borrowing money directly from people rather than banks or credit institutions. Some lenders may perform hard credit inquiries.

US Bad Credit Loans. Anyone who has ever borrowed money from a friend or relative has participated in peer-to-peer P2P lending albeit informally. Pros and Cons of P2P Lending for Borrowers.

It is possible to use P2P lending for p2p loans bad credit scores. JUMBO ASSET BASED. Listed are a few of the most.

P2P Credit offers personal loan access to borrowers with bad credit. According to data gathered from Lending. Best Bad Credit Loans for Instant Loan Approvals.

OneMain Financial offers a pretty good range of loan options for people who need to borrow money. Loans for Bad Credit. The interest rates offered are so attractive that many borrowers are now seeking to get peer-to-peer personal loans to pay out their high-interest credit card debts and expenses.

You can borrow anywhere from 5000 to 40000 with APRs of 599 to 2499 and terms of two to five years. The P2P lending pool isnt very large but its still large enough to narrow down to six best platforms. Best for Connecting Borrowers to Reliable Lenders in Minutes.

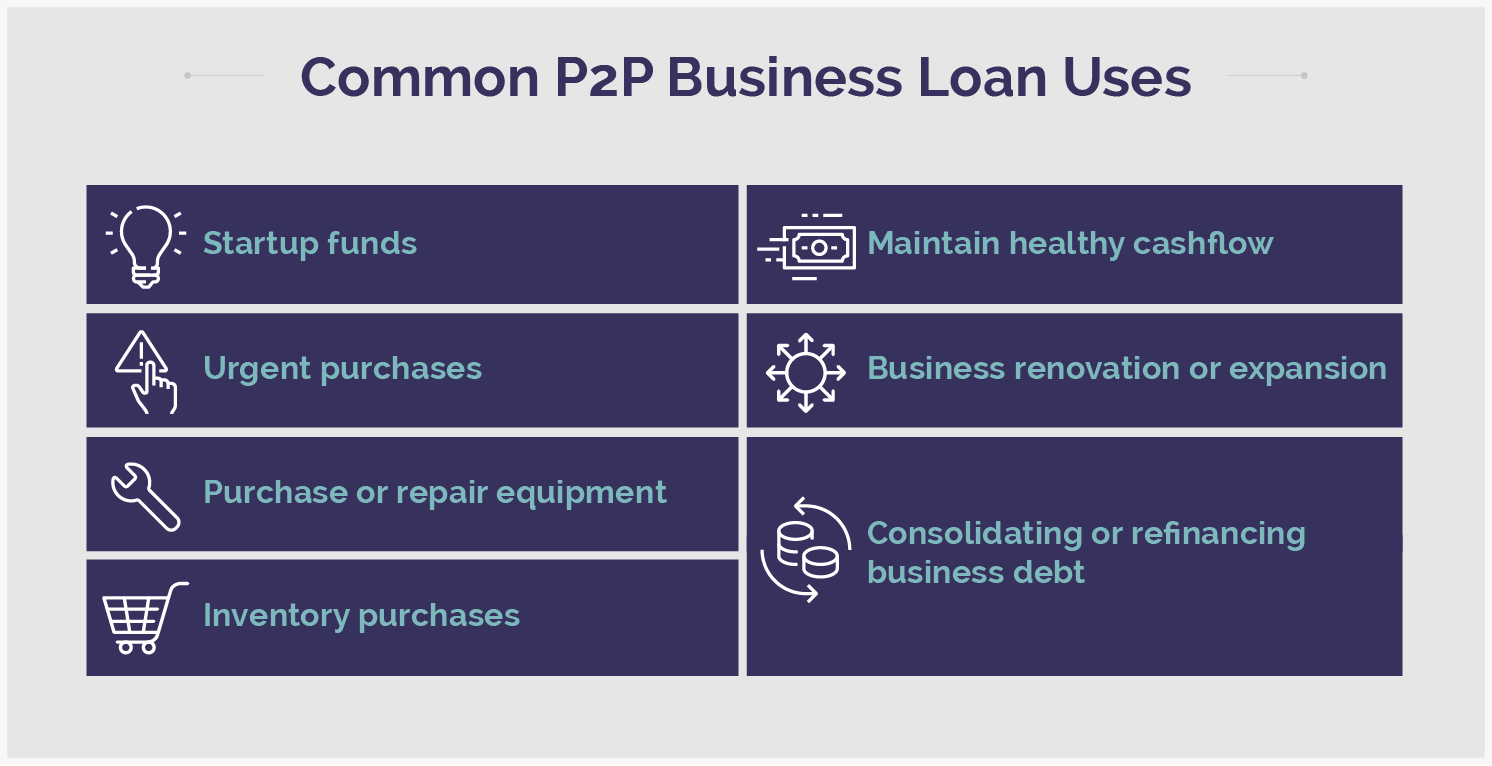

Rates can get fairly high for bad credit borrowers but are still well below rates on payday lending or credit cards. Peer-to-peer P2P financing is the opportunity where people do not need to make use of the official institution that is financial an intermediary. No collateral These P2P loans are unsecured so you dont need collateral.

2 days agoLoan Amounts and APRs. US Bad Credit Loans. A peer to peer loan is just what it sounds like.

You can find benefits and drawbacks of P2P loans for bad credit and they are the following. Thats why P2P Credit offers bad credit debt consolidation loans to those who have poor to average credit. However with peer to peer lending you are likely still eligible to get a loan with a fair interest rate even if you have bad credit.

US Bad Credit Loans - Best For. Corp LLC 1st 2nd Mortgages No Seasoning Purchase Refinance Cash-Out Equity Bad Credit Allowed. Peer-to-peer P2P lending sometimes called social lending or crowd lending allows borrowers to get a loan from other individuals.

And while the digital age has given peer-to-peer lending a facelift the concept is hardly a new one. Alternative lending for all Jumbo loan products. No tax returns No credit for Residential Investment and Commercial properties.

Having less than perfect credit shouldnt stop you from receiving the benefits of consolidating your debts. Happy Money offers bad credit P2P loans. So if youd like a loan along with good credit you may well ask from P2P loan providers they assess the.

Peer to peer loans for bad credit is one relatively easy way to get a loan with bad. Pros of P2P Lending. As the name implies P2P lending allows borrowers to obtain bad credit loans directly from individuals willing to lend to them.

Instead of a company or some other type of lender lending you money an individual loans you their own personal money instead. Best for same-day payday loans for bad credit. Best Bad Credit Loans with Flexible Repayment Terms.

Peer to peer loans or P2P loans are an alternative to payday loans that can allow you to have access to money even if you have bad credit.

Peer To Peer Lending Bad Credit Fifi Finance

Best P2p Lending Platforms For Bad Credit In 2021 Myconstant Blog

A New More Accurate Model Of Default For P2p Loans Badcredit Org

Top Options For Peer To Peer Business Lending Lantern By Sofi

Flow Cares P2p Lending Can Offer Easy And Cheap Loans But Don T Get Trapped

9 Things Borrowers Should Watch Out For Lendingtree

P2p Lending Explained What Is Peer To Peer Lending

The 3 Main Risks With P2p Loans The European Business Review

6 Best Online Peer To Peer Loans For Bad Credit 2022 Badcredit Org

Akseleran Facilitates P2p Loans For Small And Medium Sized Businesses Badcredit Org Badcredit Org

How Does P2p Lending Work Quora

Loans For Bad Credit P2p Credit

Top Options For Peer To Peer Business Lending Lantern By Sofi

Ultimate List Of Crowdfunding Loans For Bad Credit Borrowers Crowd101

These Three Best P2p Lending Platforms Could Increase Your Returns Learnbonds Com

P2p Lending A Quick Way To Get Rich Sse Riga Investment Fund

Peer To Peer Lending Types Advantages